In India, the disparity between the poor and the rich is growing at an unprecedented rate. Financial exclusion is considered one of the major causes of disparities between the poor and the rich. Poverty-driven areas remain excluded from financial services due to lack of exposure, awareness and accessibility. According to the 2011 census, India is home to 1.210bn people* but the sad truth is almost 76% of the population isn’t financially literate, as per research conducted by Charvi Bhatia in her journal ‘The Need for Financial Literacy Among Youths’, dated August 2018.

According to VikasPedia, 48.5% of the Indian population is female** and as per India's 2011 census, India is projected to have a 34.33% share of youth (15-24) by 2020***; therefore, to fuel economic growth, it is imperative to empower them with financial inclusion.

It is one of the most important life skills which enables members of our youth to not only thrive

but thrive independently. Miracle Foundation India, in collaboration with the ICICI Foundation, addressed this as an immediate need for our children.

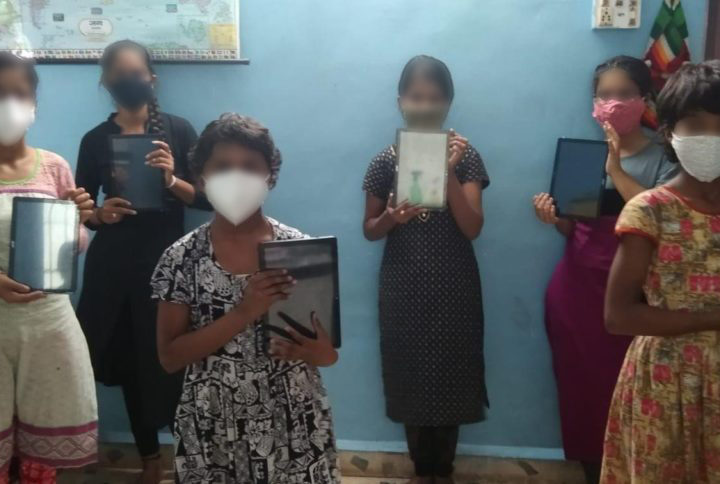

We commenced a series of online Financial Literacy Sessions for children in our care. The financial literacy sessions covered two main topics:

- Rural Financial Literacy

- General Financial Literacy

The sessions were highly insightful and stirred a sense of intrigue towards the importance of financial literacy. Finance Education, officially, isn’t a topic that is covered by academic institutions, which in turn leaves children vulnerable in terms of money management when they grow older.

The 1st session glanced over rural financial literacy and the session included

- Opportunities in agriculture

- How organic farming and dairy farming can be game-changers

- National Bank for Agriculture and Rural Development (NABARD)

- Dairy Development Entrepreneurship Scheme (DEDS)

- Capital Investment Subsidy Scheme

- Crop Loan/KCC Card and other agricultural loans

- Self Help Groups (SHGs)

- PM Employment Generation Programme

- PM Mudra Yojana

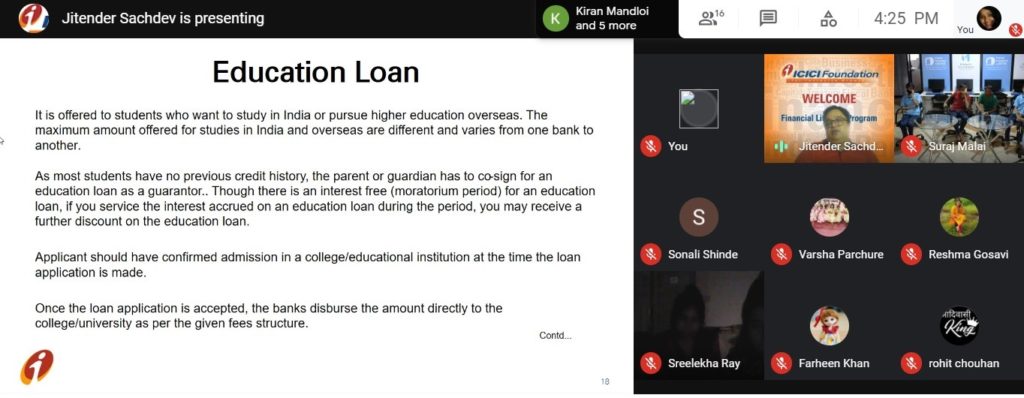

The 2nd session went over ‘General Financial Literacy’ and the importance of it in a person’s life. the session included topics like:

- Importance of Saving & Banking

- Types of Bank Accounts (Savings/Current/Fixed Deposits/Recurring Deposits, MODs)

- Shares and Mutual Funds

- Budgeting/Financial Planning

- Education Loan

- PM Mudra Loan

- Modes of Remittances

- Life & Health Insurance Planning

- Social Security Schemes (PMSBY & PMJJBY)

- CIBIL

- Awareness of Frauds

Key learnings for the children:

- Children were aware of what a saving account was but now, they are aware of other types of accounts and their purposes

- Children in alternative care like aftercare, independent living, group living, etc. are working and they need to know different investment options. The knowledge of shares, mutual funds, health insurance, life insurance was crucial for them to plan a productive investment scheme.

- Preparation of a budget and instilling the right Financial Planning habits into the children

- Social schemes and how they’re an added benefit for them

Orphan girls, often, don’t consider starting a business. However, the knowledge of the Mudra Scheme will enable them to think about micro-enterprise initiation

Some quotes from Mukta girls:

Financial Literacy is a topic that has to be addressed at the micro as well as macro levels. At the micro-level, a child’s guardian, parents, and/or caregivers are responsible for introducing and instilling financial literacy among their children, and at a macro level, the academic curriculum should be designed to incorporate aspects of financial literacy in a bid to empower our youth to gain their financial autonomy.

Archana Karode,

Social Worker

**https://vikaspedia.in/social-welfare/women-and-child-development/women-development-1/status-of-women-in-india#:~:text=Related%20resources-,Population,are%20949%20and%20929%20respectively.